Crypto Attraction Flywheel drives each boom and bust crypto cycle, consisting of the following:

- An attractive tagline

- Real products to fulfill #1

- New participants attracted by #1, but stay engaged with #2

In 2017, the tagline was explicitly: “come get rich”. Before that, it might have been: “come share Libertarian or ideas of a decentralized future”. Those ideas still exist today, but each cycle adds additional surface area to attract new participants who might not care about prior ideals. For example, there are more people that care about making money than those who care about decentralizing everything, which is why 2017 expanded the base of users beyond the ideological. In the 2020–2021 cycle, the surface area for attracting participants has expanded well beyond “come get rich”.

At this stage, the below are a list of well developed areas. I’m sure there are budding areas I’m missing:

- “Come get rich while building and participating in a weird, new, and nerdy new financial system” — Decentralized Finance (DeFi)

- “Come take part in a new artistic medium, artistic culture, and support artists” (you can still get rich) — Non-Fungible Tokens (NFTs)

- “Come join a decentralized community of like minded people and organize financially towards some common goals” — Decentralized Autonomous Organizations (DAOs)

- “Come play crappy games that fuse some aspects of all the above” — Crypto Gaming

Crypto ecosystem has a predecessor: The internet. The internet was once a crazy idea and today it is integrated into daily life and culture. Between “crazy idea” and “integrated into daily life” lives a spectrum of improvements, innovations, and use cases that brought more people to the internet.

While I wasn’t born before the internet, I do remember the time before everyone had a smartphone. I was a late adopter of mobile technology — I didn’t get a smartphone until 2011. One day while sitting at home, a friend called me. He was lost somewhere in Los Angeles after taking some turns to avoid traffic. He needed help getting home, so he called me and asked me to pull up Google Maps and navigate him step by step. We still laugh about it today. The use case is obvious now, but there was a time where we questioned the usefulness of smartphones.

I believe we are in that phase with crypto: questioning the usefulness of the technology and ethos. Rightly so. There are a lot of tools and innovation that need to be built, but it’s happening at a lightning pace that missing a month feels like years. It’s an exciting time to jump in, get involved, and be an early participant and contributor.

The best piece of advice is to get your hands dirty in the real, unpredictable, and fast-moving world of crypto. It reminds me of the famous quote by Alfred Korzybski: “The map is not the territory”. For the food motivated, Alan Watts’s quote might better hit the spot: “The menu is not the meal”.

Descriptions, tweets, and essays (including this one) is only a menu of what can be experienced in the crypto world. The meal itself happens the moment you begin to interact with the ecosystem and it opens up an experience a menu could never describe.

So, go make and collect some NFTs, participate in a DAO that piques your interest, play one of these crypto games, or trade tokens and move money around in DeFi. If none of those are interesting, sniff out the edge cases that seem interesting to you — it might be the next item on the flywheel and you’ll be rewarded for being early.

Floor plan of 196 square foot studio drawn by child.

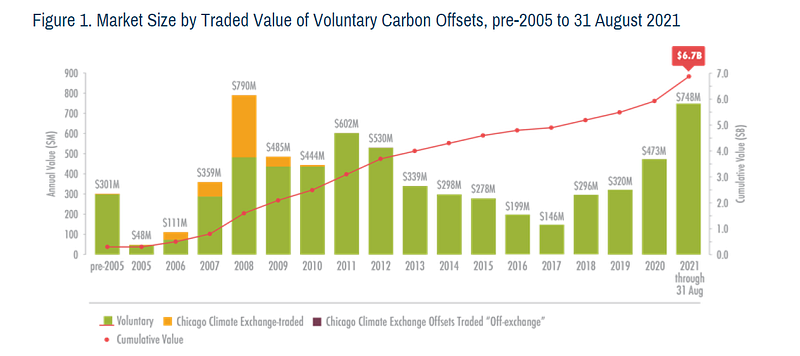

Floor plan of 196 square foot studio drawn by child. Growing voluntary carbon market from 2005 to 2021.

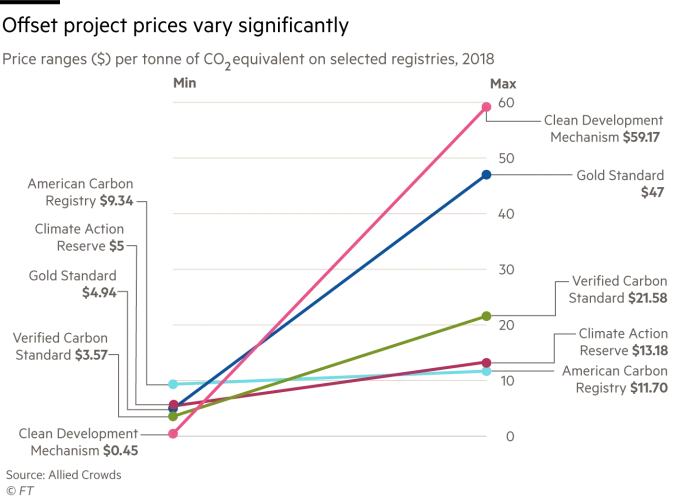

Growing voluntary carbon market from 2005 to 2021.  Variance of carbon credit prices, both between and within registries.

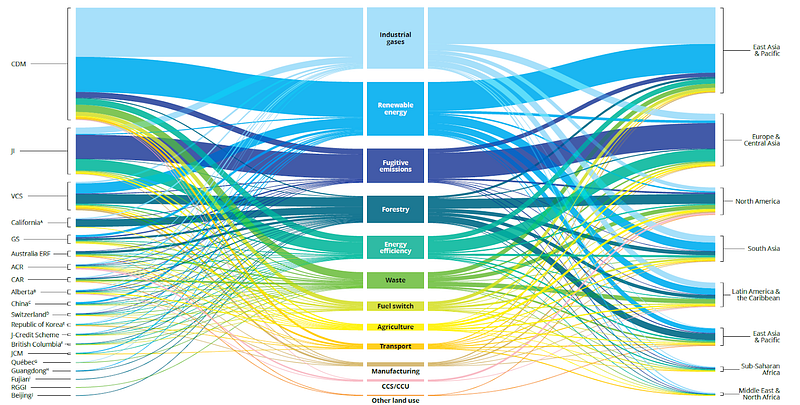

Variance of carbon credit prices, both between and within registries.  The range of carbon credit project categories by registry and region through 2019.

The range of carbon credit project categories by registry and region through 2019.